The Rep’s continued success has been made possible by the generous contributions of our volunteers, patrons, artists and sponsors.

Now for the first time in our 42 year history, the Rep and its community members are “homeowners.” We not only need to keep our lights on, we want to develop and expand our current space in order to increase our presence and support in the community. The goal is to improve the space for our volunteers and audience members. We plan to do this thoughtfully and carefully; to raise the funds to create a vision that is not only realistic, but supportive of our mission.

We are not just creating a theatre in our community,

we are creating a community in our theatre.

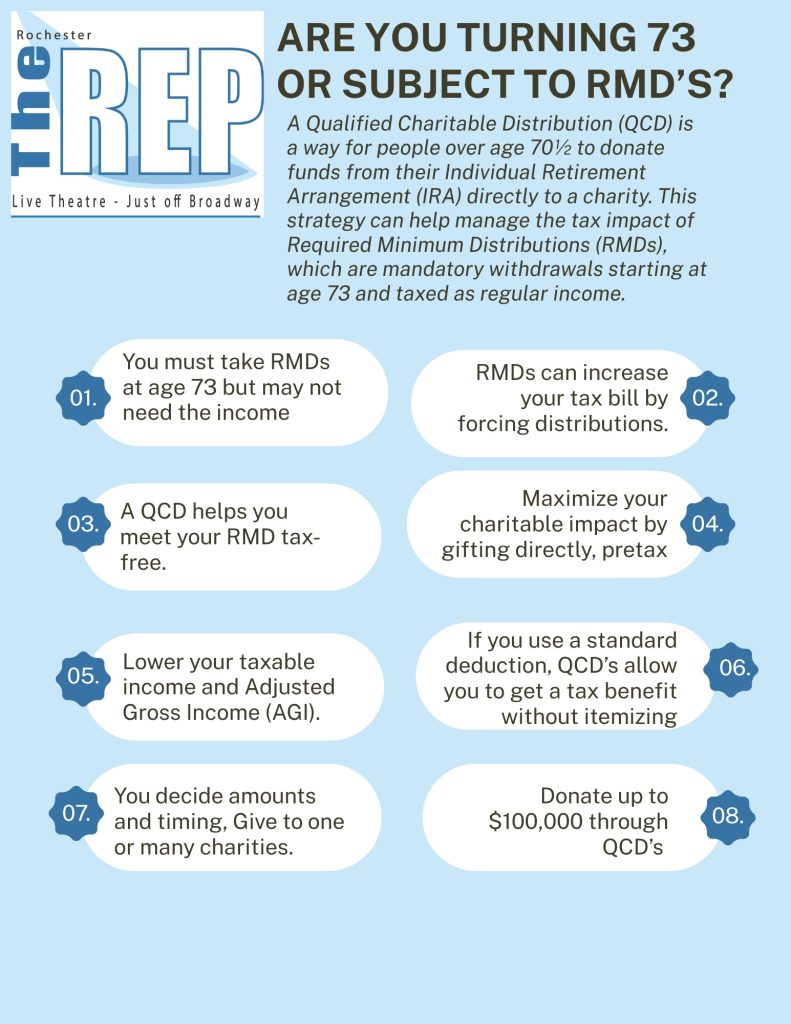

New Ways To Give!

- Contact your IRA custodian: Get in touch with the financial institution that holds your IRA. This can be done online, by phone, or by visiting a branch

- Submit the request: Your custodian will likely have a specific form or process for QCDs, which may be found on their website or provided to you. You’ll need to make the request in writing, specifying the dollar amount and the name of the charity

- Specify the charity: Provide your custodian with the full, correct name and address of The Rep. The check must be made payable directly to the charity, not to you

The Rochester Repertory Theatre Company

PO Box 6537

Rochester, MN 55903 - Send the check: The custodian will either mail the check directly to the charity or send it to you to deliver. If it comes to you, it must still be payable to the charity

- Keep records: Maintain all confirmation from your custodian and the charity’s acknowledgment letter for your records and tax purposes. Your custodian will send you a Form 1099-R at year-end, but the QCD itself is not a taxable distribution

- Timing: Be aware that a QCD must be completed by December 31st to count toward your Required Minimum Distribution (RMD) for that year. Some charities may also have a minimum contribution amount

Pictured: Kathy Keech in Master Class. Photo by Tony Drumm

Pictured: Kathy Keech in Master Class. Photo by Tony Drumm

The Rep is a registered non-profit 501(c)(3) charitable organization and your financial donations are tax deductible in accordance with relevant tax codes.